How Much Does Garage Door Insurance Cost?

Finding the right garage door insurance can be tough. We need to look at what affects the cost. Homeowners insurance, which might cover garage repairs, costs between $1,000 to $2,000 a year. The price changes based on where you live, how much coverage you want, and your deductible.

It’s important to know that most claims are for wear and tear, which isn’t covered by insurance. But, your policy might cover damage from natural disasters like hail. Knowing what your policy covers is key. With this in mind, we can look for affordable garage door insurance.

Exploring garage door insurance, we find that extra protection costs about 20% more. Detached garages might need their own policy, which can raise your premium by 40%. By understanding these points, we can choose the best insurance for our budget. This leads to finding affordable insurance that fits our needs.

Understanding Garage Door Insurance Coverage

Protecting our homes is important, but we often forget about the garage door. It’s key to know what insurance covers and what it doesn’t. To find the best rates, we need to look closely at what’s included.

Homeowners insurance might help with garage door repairs in some cases. For example, after a natural disaster or if a vehicle hits it. But, it won’t cover damage from accidents or normal wear and tear.

Getting quotes from different providers can help us find the right insurance. Homeowners insurance usually covers damage from hail and strong winds. But, it might not cover damage from earthquakes or floods.

Most policies will pay for garage door repairs after a car accident. They also cover damage from break-ins or vandalism if we report it to the police.

But, normal wear and tear isn’t covered. So, we must take care of our garage doors ourselves. To get the best rates, we should look at the different coverage options. Knowing what’s included helps us make smart choices and find affordable insurance.

Average Garage Door Insurance Cost in the United States

The cost of garage door insurance varies a lot. It depends on where you live, the type of garage door, and how much coverage you want. On average, small garage door businesses pay between $37 and $59 a month. This is about $444 to $708 a year.

For homeowners, the average yearly cost is $1,820. This might cover damage from windstorms, hail, lightning, fire, break-ins, and car accidents.

When looking at garage door policy premiums, think about the coverage and deductible. Homeowners often choose a $1,000 deductible. To get cost-effective garage insurance options, compare quotes from different companies. Some insurers offer discounts for bundling or adding security features.

Several things can change how much you pay for garage door insurance:

* Where you live and the area

* The type of garage door and materials

* How much coverage you get

* The deductible you choose

* If you have security features and safety measures

Understanding these factors helps homeowners make smart choices. They can find a policy that fits their needs and budget.

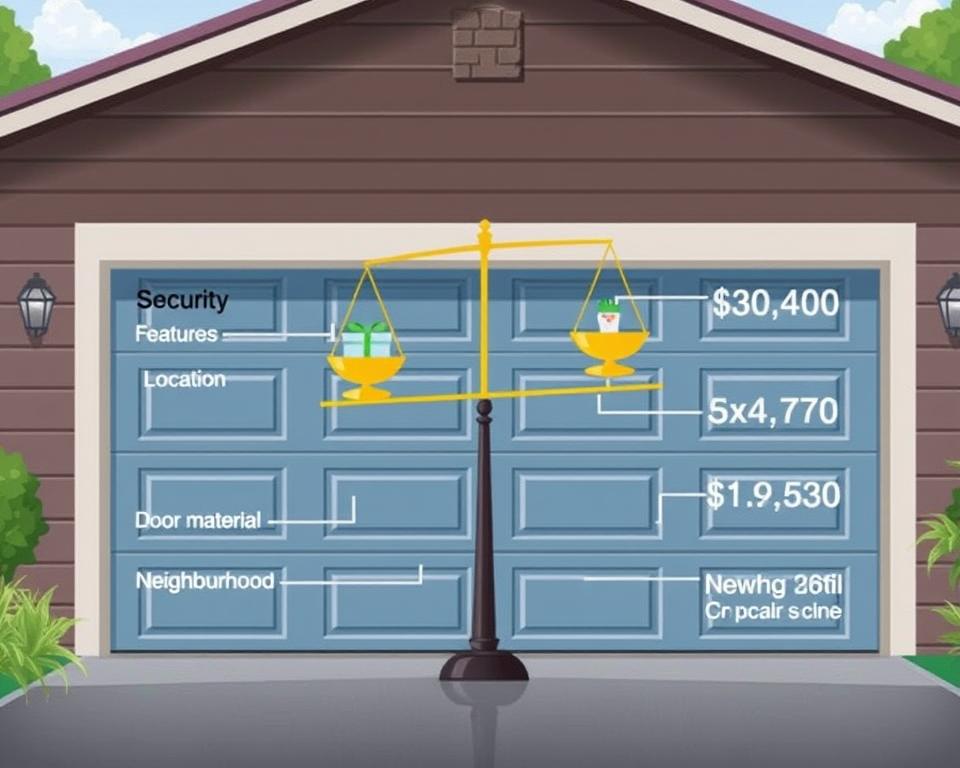

Factors That Influence Your Garage Door Insurance Rates

Several factors affect your garage door insurance cost. We look at the type and material of your garage door, its age, and condition. For example, steel doors are better at resisting fire than wooden ones. This can change your rates for fire claims.

Where you live also matters. Areas with high winds or extreme weather pay more for insurance. Having security features like smart garage door tech can also raise or lower your rates. Strong security can prevent theft and vandalism, which are big factors in insurance costs.

Some key factors that affect your garage door insurance rates include:

- Garage door type and material

- Age and condition of your garage door

- Location and environmental risks

- Security features and safety measures

Knowing these factors helps you find affordable garage door insurance. Regular checks and maintenance can spot problems early. This might lower your insurance costs.

We aim to give you the latest info to help you choose the right garage door insurance. By considering these factors and keeping your garage door in good shape, you can get better rates. This means more protection for your property.

Smart Ways to Reduce Your Garage Door Insurance Premium

Many homeowners want to lower their insurance costs. To do this, comparing garage door insurance costs is key. This way, you can save money while keeping good coverage. Getting multiple quotes and comparing them is a smart move.

Keeping your garage door in good shape is also important. Upgrading to a garage door with safety features can cut your premium by 5-10%. In areas with strong winds, a cyclone-proof garage door can lower premiums by 10-15%.

Here are more ways to lower your premium:

- Installing security cameras and smart door openers can reduce premiums by up to 20%

- Waterproof garage doors can lower premiums by 10% in flood-prone areas

- New garage doors often mean lower premiums

By using these strategies, you can lower your insurance costs. Always compare garage door insurance costs to find the best rates. This way, you get a great deal without sacrificing coverage quality.

Taking the Next Step: Securing Your Perfect Coverage Plan

Finding the right garage door insurance plan is about finding a balance. You need to consider what you need and what you can afford. Now that you know about typical coverage and costs, it’s time to find the perfect plan for your home.

Start by checking your current homeowners insurance policy. See if your garage door is covered. If not, there are many affordable options out there. Some plans start at just $27 a month, with choices for service fees to fit your budget.

Regular maintenance is important to keep your garage door in good shape. Choosing the right materials and safety features can help avoid damage from the weather. This way, you can enjoy your home without worrying about garage door problems.