Can You Claim a Garage Door on Insurance?

Many of us wonder if our homeowners insurance covers our garage doors. It’s important to know what damages are covered when filing a claim. Homeowners’ insurance often covers damage from natural disasters like hail or wind-blown debris.

We’ll look at how to file a claim for garage door insurance. We’ll also see what damages are usually covered. This includes vehicle damage, natural disasters, and vandalism.

Understanding garage door insurance claims is key. Most homeowners insurance policies cover damage from specific incidents. This includes vehicle impacts, theft, vandalism, fire, and certain natural disasters. Knowing this can give us peace of mind.

We’ll also talk about the differences between attached and detached garages. We’ll see how they affect insurance coverage. It’s important to understand our insurance policy when filing a claim for garage door damage insurance.

About 80% of homeowner’s insurance policies cover garage door damage from vehicle accidents. But, damage from wear and tear is usually not covered. As we explore garage door insurance claims, we’ll help you understand your policy and what damages are covered.

Understanding Garage Door Insurance Coverage

Knowing what your garage door insurance policy covers is key. Homeowners insurance usually protects your home, belongings, and other people’s property. But, each policy is different, so it’s vital to know what’s included and what’s not.

We’ll explore the insurance policies that cover garage doors. We’ll also look at common limitations and extra coverage options. For example, standard homeowners insurance and “other structures” policies might apply. But, the details can vary. It’s also wise to think about extra coverage like flood or earthquake insurance to fully protect your garage door.

Types of Insurance Policies That Cover Garage Doors

Several insurance policies can cover garage doors, like standard homeowners insurance and “other structures” policies. These can help with repair costs, but it’s important to check your policy. Some policies might also offer extra coverage, like for floods or earthquakes, to protect your garage door even more.

Common Coverage Limitations and Exclusions

Insurance for garage door repair offers financial security, but there are limits and exclusions. For instance, wear and tear isn’t usually covered. Also, damage done on purpose won’t be covered, and lying about it can lead to legal trouble. Knowing these can help you choose the right policy and ensure you’re covered.

Understanding your garage door insurance helps you make smart choices. Review your policy to see what’s included. Think about extra coverage options. And, be aware of common limits and exclusions. With the right insurance, you can safeguard your investment and feel secure.

When Does Insurance Cover Garage Door Damage?

Many of us wonder when our insurance will cover garage door damage. The key is to understand the claim process and what damages are covered. Homeowners’ insurance usually covers damage from severe weather like windstorms, hail, and lightning.

Some common damages that are covered include:

- Wind damage

- Hail damage

- Fire damage, including soot and smoke damage

- Break-ins that cause damage to the garage door

- Vehicle-related damage to the garage door

But, general wear and tear, intentional damage, and poor maintenance aren’t covered. Knowing your policy and the claim process helps you file a claim and get repairs or replacements.

Choosing the right insurance provider and knowing what’s covered protects your garage door. Always review your policy and ask questions to make sure you have the right coverage.

Filing a Garage Door Insurance Claim: Step-by-Step Process

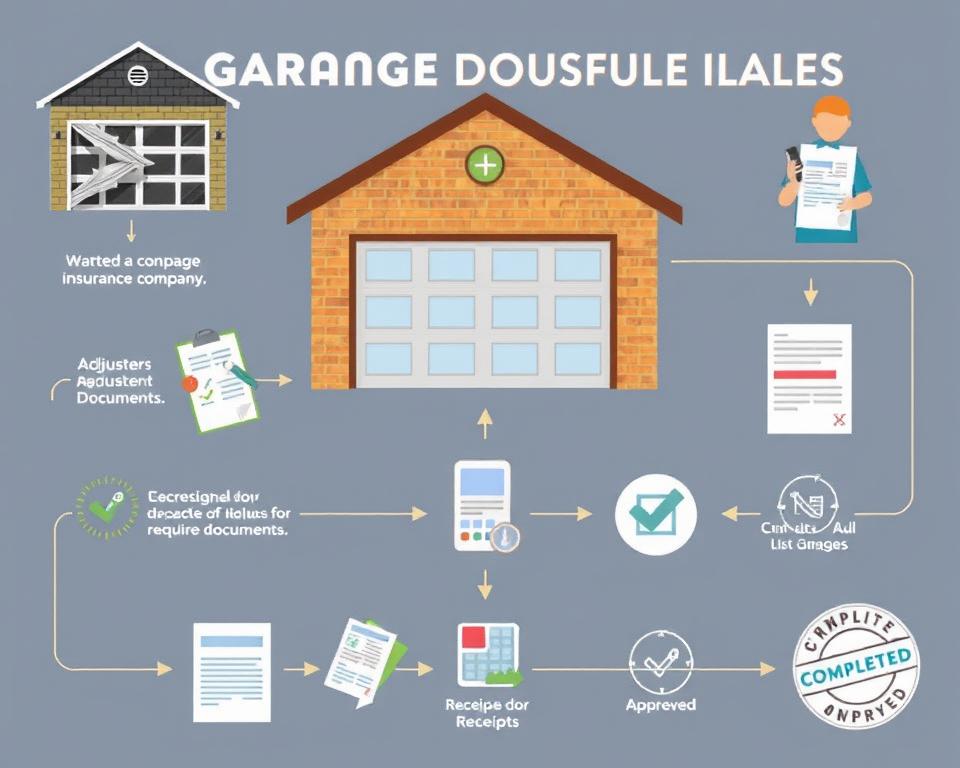

Filing a garage door insurance claim requires knowing the steps and what to expect. We’ll walk you through the process of filing a claim for garage door insurance. This way, you’ll have all the info you need to move forward smoothly.

First, check your garage door insurance coverage to see what’s included. This helps you decide if filing a claim is right for you. If you choose to file, take photos and notes of the damage. These will be important for your claim.

Then, call your insurance company to report the damage and start the claim. Be ready to give them all the details about the incident. You might also need to work with claims adjusters to figure out how much coverage you have.

To make the claims process easier, keep good records of everything. This includes all your talks with your insurance and any documents you have, like repair estimates. By following these steps and knowing your garage door insurance coverage, you can have a successful garage door insurance claim.

Common Causes of Garage Door Damage That Insurance Covers

Knowing what damage is covered by garage door insurance is key. Natural disasters, accidents, and vandalism are common causes. We’ll dive into these to help you understand your insurance better.

Most policies cover damage from storms like hail and strong winds. About 80% of policies include this coverage. Also, 90% of damages from the policyholder or their family are covered by homeowner’s insurance.

Natural Disasters and Weather Events

Natural disasters like hurricanes and tornadoes can damage garage doors a lot. It’s important to know what your insurance covers in these cases. Make sure to check your policy for adequate coverage.

Accidents and Collisions

Accidents, like car damage, can also harm garage doors. It’s vital to understand how to file a claim for these damages. About 10% of garages get damaged by cars each year.

In summary, knowing what your garage door insurance covers is key. This knowledge helps you navigate the claim process better. It ensures your garage door is well-protected.

Understanding Your Insurance Deductible and Coverage Limits

Knowing about your garage door insurance is key. It’s important to protect our garage doors from unexpected damage. The right insurance policy gives us peace of mind. On average, replacing a garage door costs about $1,250, which is usually covered by insurance.

But, it’s vital to check our policy for specific coverage and deductibles. The cost of garage door insurance varies. It depends on the door type, location, and damage extent. Some policies might have deductibles higher than repair costs.

- Coverage limits: The max our policy will pay for damages or repairs.

- Deductibles: The amount we must pay before insurance kicks in.

- Exclusions: Certain perils or situations not covered by our policy, like flooding or intentional damage.

By understanding these and reviewing our policy often, we can ensure we have enough coverage. This way, we’re ready for any unexpected events.

How to Choose Between Repair and Replacement Claims

When your garage door gets damaged, you need to think about your options. We look at the garage door’s age and condition. We also consider the garage door insurance cost and what your garage door insurance provider offers.

It’s important to know what your garage door insurance coverage includes. Homeowners insurance often covers damage from things like fire, wind, and hail. But, it doesn’t cover wear and tear from regular use.

Cost Considerations

Cost is a big factor in choosing between repair and replacement. We compare the cost of fixing the door versus replacing it. If the repair cost is almost as much as a new door, replacing might be better.

Age and Condition Factors

The age and condition of your garage door matter too. If it’s old or in bad shape, replacing it might be the best choice. This is because older doors might not be covered by insurance, and repairs could be expensive.

Insurance Company Preferences

We also think about what your garage door insurance provider prefers. Some insurance companies have specific rules for repairs or replacements. It’s key to understand your garage door insurance coverage to know what’s included and what’s not.

Protecting Your Investment: Smart Tips for Garage Door Maintenance

To keep your garage door in top shape and avoid expensive garage door insurance claims, regular maintenance is key. A few simple steps can help your garage door last longer and reduce the chance of garage door damage insurance issues.

Begin by setting up yearly checks with a skilled technician. They can spot problems early and suggest ways to prevent them. Also, fix any wear or damage right away, like broken springs or panels. Quick action when filing a claim for garage door insurance ensures you get the help you need.

Choosing a top-notch garage door from a trusted brand like Clopay is wise. These doors are made to last and need fewer insurance claims. Plus, they often come with long warranties for extra peace of mind.

By keeping up with garage door care and making smart choices, you can safeguard your investment and cut down on insurance claims. A well-kept and attractive garage door can also boost your home’s value and lower insurance costs.